The low car insurance blog 5479

AboutUnknown Facts About How Much Is Car Insurance For An 18 Year Old?

Turning 18 years of ages is the start of adulthood. You are eligible to vote, open your own lines of credit, and in numerous states, own a vehicle. Whether you're shopping for car insurance for the first time or looking for a cheaper policy, automobile insurance for 18-year-olds can be expensive.

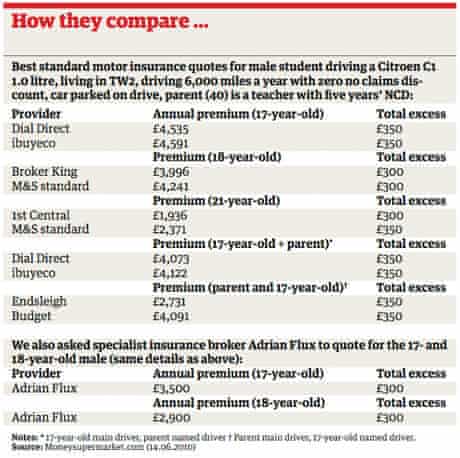

When you're prepared to start comparing cars and truck insurance for 18-year-old motorists, enter your zip code below or call our group at for complimentary, customized quotes seven days a week.: What Is The Average Automobile Insurance For 18-Year-Olds? Since 18-year-old drivers do not have much experience behind the wheel, these chauffeurs are thought about high-risk.

Facts About Car Insurance For Teens - Tips For Parents - Consumer Reports Revealed

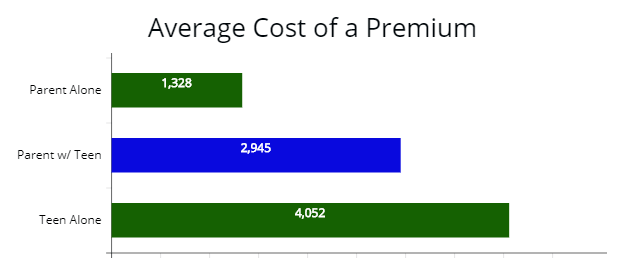

According to The Zebra's State of Vehicle Insurance coverage research study, the average vehicle insurance for 18-year-old drivers runs about $4,700 each year or nearly $400 per month. The same study discusses the savings 18-year-olds can see if they remain on their moms and dads' insurance coverage policy rather of starting their own it has to do with $2,600.

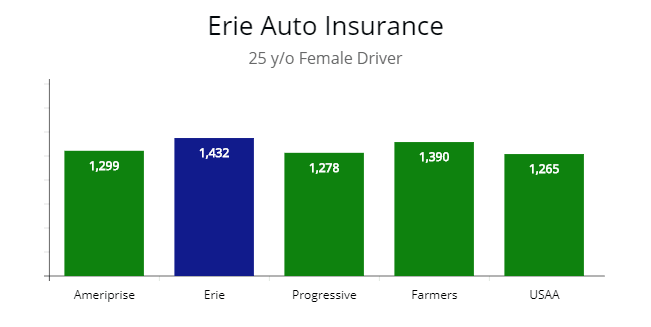

Even at 18, you are still thought about relatively unskilled and more at danger on the road to vehicle insurer. This is why the average car insurance coverage for an 18-year-old is greater than someone who is in their mid-twenties. Being an 18-year-old woman might mean lower cars and truck insurance coverage rates compared to an 18-year-old-boy.

An Unbiased View of How To Buy Auto Insurance For 18 Year Olds

The less claims, accidents reported, or citations you have actually had, the less of a danger you are seen to the insurance coverage business. Accidents happen, and when they do, don't be alarmed if you see your policy considerably go up. If you remain in the market for the best cars and truck for your teen, you're most likely considering 2 things: safety and price.

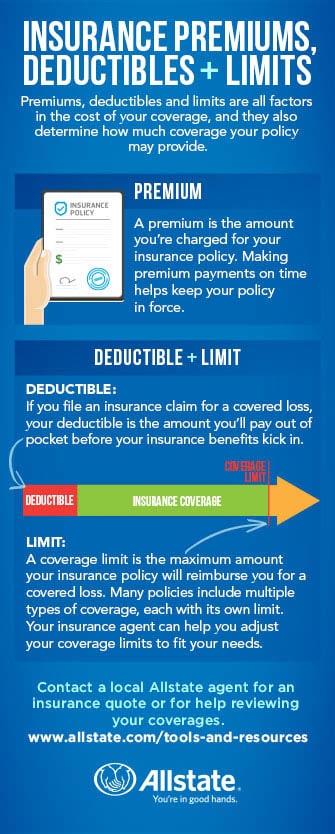

Thinking about how much you can pay out-of-pocket for your teenager's automobile affects the cost Discover more of your cars and truck insurance premium. The limitations and deductibles you choose will figure out how pricey your cars and truck insurance coverage rates are, so it's crucial to shop around for policies. How To Minimize Automobile Insurance For An 18-Year-Old From discount rates to usage-based savings programs, there are numerous methods for teens to save money on automobile insurance.

The 2-Minute Rule for How Much Is Car Insurance For An 18-year-old?

If you accelerate and brake securely, you can save on automobile insurance. Usage-Based Automobile Insurance Coverage For Teenage Motorists Usage-based programs can help you conserve cash on teenager cars and truck insurance. When you think about how pricey the typical car insurance coverage for 18-year-old motorists is, taking the time to drive safely can have great benefits.

A few of the cars and truck insurance coverage discount rates you can get for 18-year-old chauffeurs consist of: Great trainee discount rate for maintaining a B average or higher Driver training course discount for finishing pre-approved courses Remote student discount rate for students who go to school over 100 miles away from house without a cars and truck Recently independent discount for drivers who were previously listed on their moms and dads policies and are now opening their own New teenager rewards for customers of over one year that are adding a teenager to their policy The Road Ahead Guide provides you general driving suggestions, pointers on driving in hazardous weather, and more.

All About 8 Ways To Cut Insurance Costs For Teen Drivers - Kiplinger

Safeco provides a parent-teen agreement that describes clear expectations and guidelines for brand-new motorists behind the wheel. Find out more in our complete Safeco insurance review. In addition to Drive Safe & Save, State Farm likewise uses Steer Clear an unique discount offered to chauffeurs younger than 25. To get this discount rate, you should: Have a valid chauffeur's license Have no at-fault accidents or moving offenses throughout the past three years Total the program requirements within 6 months of registering Consumers who enlist need to complete modules about safe driving.

Our research study discovered that these providers have budget-friendly rates and great protection for young motorists. Enter your zip code in the quote box listed below or call to get started.

Indicators on How Much Is Car Insurance For An 18-year-old? - Wallethub You Should Know

It is a recognized brand name that has actually been serving young grownups and moms and dads with dependents considering that 1912, which has earned it a 4. Some of the protection benefits that are helpful for young motorists are: This strategy will secure your premium against heightened rates after your first at-fault mishap, which can be helpful for newer motorists.

The discount is based upon total miles driven, nighttime driving, braking, and acceleration. If you're interested, we recommend reading our review of Liberty Mutual completely and contacting a representative to get matched with the very best quotes in your area. If you're trying to find a relied on company to secure your current high school student or current graduate, State Farm insurance is for you.

Top Guidelines Of Auto Insurance

The very best way to reduce your teen's cars and truck insurance coverage rate is to include them to your existing insurance coverage if they currently have their own and then search for discount rates to further decrease the expense. Other noteworthy ways to lower the expense of teenage automobile insurance coverage consist of lowering your teenager's protection and getting numerous quotes.

For example, they may have the ability to get a discount rate if they take an approved defensive driving course or stay accident-free for a certain amount of time. Lower coverage Considering how expensive cars and truck insurance is for young motorists, your teen might save money on their premium by limiting the quantity of coverage they include on their policy.

10 Easy Facts About Teen Driving - Nhtsa Explained

Get numerous quotes The finest way to lower teenager automobile insurance is to search for quotes from a minimum of 3 different providers, particularly if your teenager is getting their own policy. Every insurance provider uses their own techniques to calculate premiums, so the rate that you obtain from one company might not be the very same as another.

To discover where to start, take a look at Wallet, Hub's picks for the finest teenager cars and truck insurer. You can also discover more info in our guide on how to lower vehicle insurance costs.

What Does How Much Is Car Insurance For An 18 Year Old? Mean?

(NHTSA) show that vehicle accidents are the leading cause of teenage deaths in the country, with over 2,000 young motorists in between ages 15 and 19 killed in 2018 alone.

Typical cost of males vs. ladies, Gender is a vital consider identifying automobile insurance coverage premiums. On top of greater premiums due to the fact that of your age, you can expect to pay more for insurance if you are male. Male chauffeurs statistically participate in riskier driving behaviors, which can lead to a greater number of and more serious accidents.

Car Insurance For An 18-year-old - Mycarinsurance123 Can Be Fun For Everyone

https://www.youtube.com/embed/jSbRGXPfneIIt is essential to keep in mind that insurance coverage laws differ by state and that there are states which prohibit using gender as a score aspect. In these states, males and females pay close to the same amount for insurance if all other aspects are equivalent. Typical annual full coverage premium Average yearly minimum protection premium Male $5,646 $1,753 Female $4,839 $1,551 Cheapest automobile insurer for 18-year-olds, Among the easiest methods to save money on your cars and truck insurance coverage is to choose a business with low average premiums.

AboutThe smart Trick of Car Insurance For Teens - Teen Auto Insurance - Einsurance That Nobody is Di

The finest method to lower your teen's cars and truck insurance rate is to include them to your existing insurance coverage if they currently have their own and then search for discounts to even more decrease the expense. Other significant ways to lower the cost of teenage vehicle insurance coverage consist of decreasing your teenager's coverage and getting multiple quotes.

Minimize protection Considering how expensive car insurance is for young chauffeurs, your teen could conserve on their premium by restricting the quantity of protection they include on their policy.

Get numerous quotes The very best method to lower teenager cars and truck insurance coverage is to shop around for quotes from at least three various service providers, particularly if your teen is getting their own policy. Every insurance company utilizes their own approaches to compute premiums, so the rate that you get from one company might not be the very same as another.

The Main Principles Of At What Age Do Car Insurance Rates Go Down? - Money ...

To find out where to begin, take a look at Wallet, Hub's choices for the best teen automobile insurer. You can also find more details in our guide on how to reduce car insurance costs.

Teaching a teenager to drive suffices to check your perseverance, but understanding how to conserve money on teenage vehicle insurance can be similarly tough. Thankfully, there are methods to take advantage of automobile insurance discount rates for teenage motorists, as long as you want to do a little research and window shopping.

If you're concerned about how to pay for insurance for a teen driver, it's important to understand where to search for discounts and which insurance business are better matched for guaranteeing your teen. Why it costs more to insure teen motorists, The cost to guarantee teen chauffeurs depends mainly on whether they are added to your policy or by themselves policy.

What Does At What Age Do Car Insurance Rates Begin To Decrease? Do?

Having a teenager added to your policy will be more affordable overall. The factor for the greater premiums is simple: teen drivers normally practice more at-risk driving behaviors.

Geico, State Farm, Allstate and Travelers are all examples of carriers that reward motorists with a premium discount rate upon completion of needed chauffeur safety training courses. Far-off student discount, If your young person driver lives away from home to go to college and leaves their cars and truck parked in your driveway, they might be eligible for a far-off student discount.

This is a great discount rate to have actually when integrated with the good trainee discount. Low-mileage discounts, Similar to the distant student, if your teenager drives the car a low number of miles each year, then ask about a low-mileage discount.

Not known Facts About Top 3 Ways To Save On Your Teen's Car Insurance - Liberty Mutual

Make the most of telematics, Modern innovation makes it easier than ever to keep an eye on your teenagers when they take to the road. Several insurers offer electronic devices that enable you to keep an eye on teen driving habits. With Allstate families can enlist in the Drivewise program, in which a small gadget is set up in the automobile.

Where to purchase teen chauffeur vehicle insurance, Knowing which carriers provide the best discount rates for teenager chauffeurs while supplying sufficient coverage is important. Comparing quotes is not only essential, it likewise allows you to see equal protection comparisons to make certain your teen has appropriate insurance coverage at a competitive cost.

What is the best utilized cars and truck for teen drivers? The car your teenager drives is a considerable element to evaluate when considering the price of insurance coverage for a teenager.

7 Simple Techniques For Best Cheap Car Insurance For Teens Of October 2021 - Forbes

Should I include my teen to my existing policy? Typically, a 16- or 17-year-old will cost less to insure by adding them to your existing policy, versus them having their own policy. This is another effective method when believing about how to reduce teenage cars and truck insurance coverage.

In addition to mentor by your own example, it is an excellent concept to register your teen in an innovative driver's education safety course. This would be an extra-cost program that goes above and beyond the minimum state requirements to pass a chauffeur's exam and roadway test. Give your teenager the chance to establish advanced skills in a regulated environment, where they can gain from errors before hitting public roadways.

If your household hasn't consolidated policies with a single insurer yet, now is the time to think about doing so as a method to offset the extra expenses of including a teen to your automobile insurance protection. As with any other purchase, it is constantly an excellent concept to contrast shop insurance coverage to discover the very best rates.

How To Get The Best Cheap Car Insurance For A 16-year-old Fundamentals Explained

As soon as you have actually figured out where you can get the best rate, and whether it makes sense to combine all of your family's insurance coverage policies with that single service provider, you should include your teen to the family policy rather than buy a different policy for your daughter or son. By putting your teenager on the household insurance coverage as a covered driver-- instead of buying an independent policy-- you can conserve money since all readily available household discount rates will also use to the teen.

How can we reduce insurance costs? You're best to be stressed-- your auto-insurance premiums are likely to skyrocket when your teenage son begins driving.

Add some more money to your emergency situation fund so you'll have the money to pay the deductible if anyone in your household does have an accident. entirely on older cars and trucks that deserve little bit more than the deductible. You might be paying more in premiums than you could ever return from the insurance provider, even if the vehicle is amounted to.

More About Finding The Cheapest Car Insurance For Teen Drivers

https://www.youtube.com/embed/498ujXzZSYgThe insurance coverage company that used the best rate for you and your partner might have some of the highest rates when you include a teenage young boy to the policy (and it's nearly always much better to include the kid to your policy instead of have him get his own policy). "One company we deal with is actually fantastic with young motorists and another is horrible," says Mujadin.

AboutGetting My How To Lower Your Car Insurance Costs - Policygenius To Work

Violations that don't necessarily show that you're a risky chauffeur may be less most likely to trigger a premium hike than others. If you have actually received a parking ticket, there's little reason for an insurance provider to use that incident to validate raising your rates. The very same goes for tickets for having your windows too heavily tinted or not wearing a seat belt, as well as fix-it tickets.

It's at the discretion of the insurer to define danger and how violations influence rates. Which Violations Are Likely to Cause Rate Boosts? While a few traffic violationsmostly non-moving violationsare not likely to affect your rate, there are a number of that will. What's more, some will affect you more than others, with the greatest increases coming with more serious infractions.

The smart Trick of 10 Confessions Of A Progressive Insurance Rep - Consumer ... That Nobody is Talking About

Here's what the comparison site found: Source: The Zebra, What Can You Do to Avoid the Extra Cost? It's clear that not all traffic infractions are equal when it concerns your insurance rates. The length of time infractions stay on your driving record can likewise differ depending on where you live.

Sometimes, however, you might have the ability to avoid the ticket from being contributed to your driving record, which will prevent your insurer from discovering out and raising your rate: In some states, you may have the choice to participate in a defensive driving course to avoid the court from adding particular infractions to your record.

Some Known Incorrect Statements About Does A Speeding Ticket Raise Your Insurance Rates? - Allstate

Some courts might offer the possibility to delay the effects of your violation in lieu of participating in traffic school. In this situation, you'll typically need to plead guilty and pay a cost on top of the fine for the offense. In exchange, the court will position you on probation for a fixed duration.

If you think the ticket is unjust or inaccurate, you can go to court and argue to have the case dismissed or reduced to a lesser infraction. If you can manage to produce doubt of the scenarios through witnesses and evidence, you could be successful. For more serious infractions, consider working with an attorney to assist.

What You Need To Know About How A Speeding Ticket Affects ... - Truths

It will not hurt to reach out to the court and discuss some alternatives it might have to keep your insurance premiums from increasing. Also, bear in mind that more major offenses can cause your insurance company to drop you totally, which might make it challenging to get protection from another insurance provider without paying extremely high rates.

Other Ways to Lower Your Automobile Insurance Coverage Expenses, Whether or not you're dealing with the prospect of a rate walking due to a traffic violation, it's an excellent idea to think about methods to minimize vehicle insurance. Here are just a few options: Each automobile insurer has its own criteria for figuring out rates, so even with an infraction on your record, it's possible to save money by switching to a various insurance company.

Speeding Ticket And Insurance - Root Insurance Things To Know Before You Buy

Ask your insurance coverage business if there are discount rates readily available that you're not making the most of currently. If you're shopping around for a policy, do the same with each insurer that provides you a quote. In most states, auto insurer utilize a credit-based insurance coverage score to assist determine your rates.

Improving credit can take some time, but the effort can settle for several years to come. Devaluing your automobile insurance might be another method to conserve, particularly if you're over-insured. Simply make sure to weigh the advantages of conserving now versus the costs you may face if you wind up needing to file a claim.

Unknown Facts About Insurance Points: What Are They And How Can You Remove Them?

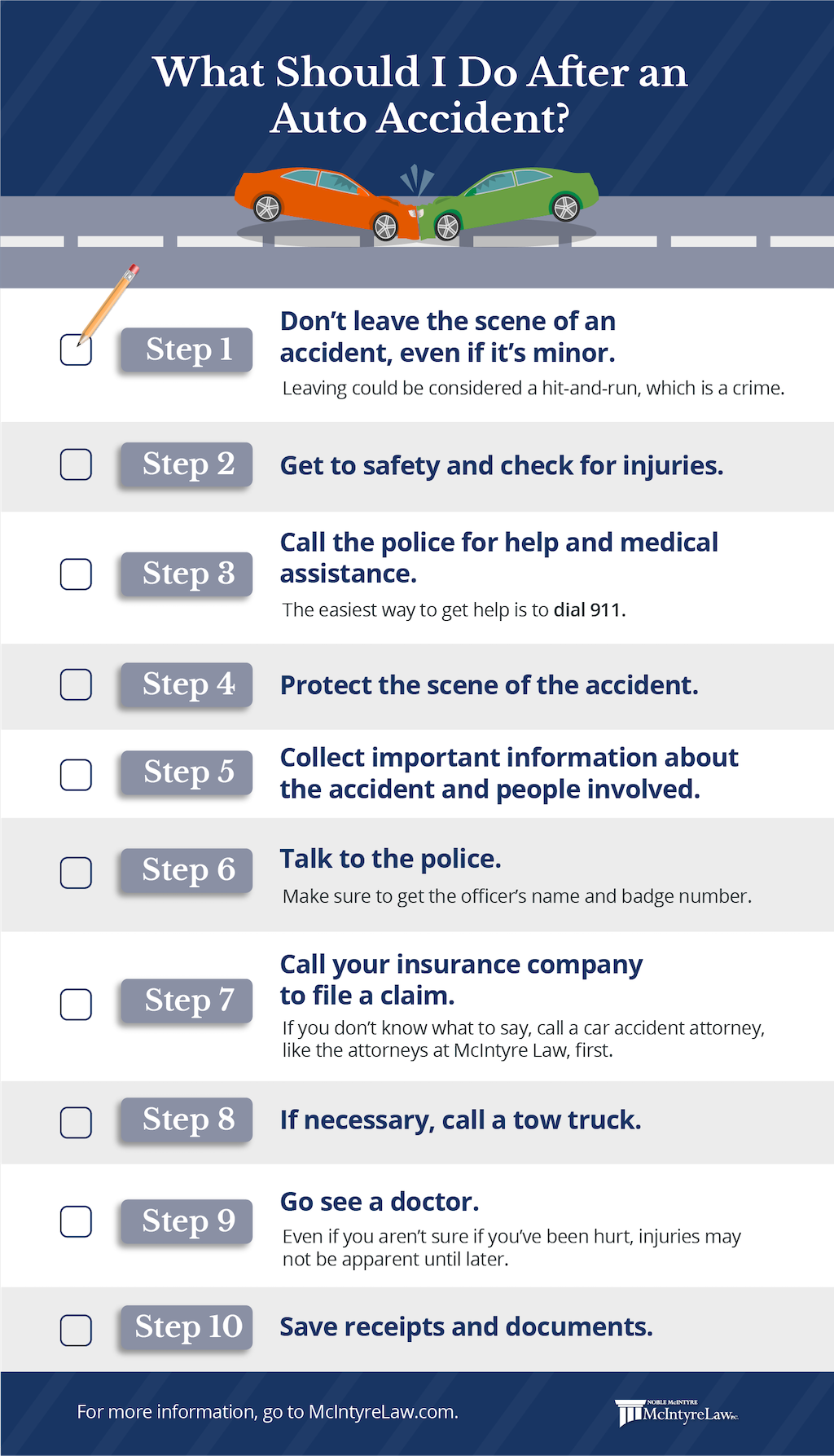

After an at-fault automobile mishap, you're most likely fretted about how your insurance rates will be impacted. It's not uncommon to see insurance premiums increase, however thankfully there are a couple of ways to get lower automobile insurance after a mishap. Car mishaps are not only mentally and physically taxing, they can also put a dent in your wallet.

We have actually likewise put in the time to review the leading car insurer if you are considering a brand-new company in the aftermath of an accident. Enter your postal code in our quote contrast tool listed below to start with free, tailored car insurance prices estimate 7 days a week. 1. Inform Your Automobile Insurance Supplier About Your Accident You may be tempted to not inform your automobile insurance provider about an accident if it is small, but telling your insurance representative is a sensible choice.

I Got A Traffic Ticket. Now What? - Farmers Insurance Fundamentals Explained

If a chauffeur sues you and you have not reported the accident to your insurance provider, the insurance coverage service provider can decline to pay your legal bills and prospective payments to the other driver. While an insurance company may raise your rates if you report an accident, it is much more secure to report than not report it.

Ask Your Car Insurance Provider About Accident Forgiveness Accidents belong of life, and some vehicle insurance provider acknowledge that by offering mishap forgiveness insurance coverage. The conditions needed by each insurer for accident forgiveness are different, so it is best to provide your supplier a call and ask what your conditions are.

Things about What Happens To My Insurance After A Speeding Ticket?

Discover more in our guide to accident forgiveness insurance coverage. Companies that offer accident forgiveness include: 3. Discover A Car Insurance Provider With A Lower Premium Providers differ in their typical car insurance coverage rates for drivers with at-fault accidents. In contrast to other leading service providers, Geico and State Farm typically provide lower cars and truck insurance after an accident.

In addition to the insurance company you select, aspects such as your age, car make and design, and driving history can impact your premium, so what's finest for your neighbor might not be best for you. Use our tool listed below to begin comparing cheap cars and truck insurance suppliers. 4. Improve Your Credit report Numerous drivers understand that car insurance coverage companies consider a driver's mishap history and whether they have a clean driving record when identifying rates, but did you understand that a motorist's credit score can likewise impact cars and truck insurance coverage premiums? According to Investopedia, lots of insurers look at a chauffeur's credit rating to figure out the insurance rates they will provide.

Unknown Facts About The 10 Worst Types Of Tickets For Your Car Insurance Rate

Therefore, it's an excellent idea to attempt to enhance your credit. Once your credit report is raised, you might have the ability to get a more economical policy from a various company or the one that you currently deal with. 5. Look Into Insurance Discounts Several automobile insurance provider provide substantial discounts to their clients.

https://www.youtube.com/embed/86p9_ycUyq8

As you can see, much of the discount rates differ based upon the specific private requesting a discount, so it is best to call the insurance business to learn what your specific discounts would be. In addition to the discounts noted below, some insurance coverage companies offer a discount rate for an anti-theft device.

AboutNine Ways To Reduce Your Teen Driver Auto Insurance Costs for Beginners

This is the average difference between the different car insurance coverage rates for various profiles. Distinction between teen vehicle insurance coverage and young driver cars and truck insurance coverage This is likewise an extremely crucial section to cover for all the moms and dads and the teenager and young chauffeurs. Many moms and dads get puzzled between teen automobile insurance and young motorist cars and truck insurance.

It is necessary to comprehend that teenager car insurance coverage is various from vehicle insurance coverage for young chauffeurs. Teenager cars and truck insurance is for the teens that are legally qualified to drive; motorists between 16 years and 19 years old. While young drivers are the ones in between 21 years and 25 years of age.

Some nationwide insurance coverage business still think about teen chauffeurs and young motorists the same. Prior to purchasing your policy, ask the insurance coverage business about teenager drivers and young chauffeurs.

Car insurance coverage rates can differ a lot for different states, cities, and even areas. The location where the chauffeur lives play a major function in the cars and truck insurance coverage cost. A motorist living in Hawaii might get lower insurance coverage rates as compared to a chauffeur in California. Thus it is essential to inspect the automobile insurance rates for various states prior to purchasing your home.

An Unbiased View of Cheap Car Insurance For Teens: 8 Best Companies - Frugal ...

These aspects include the condition of the road, the environment type, and the crime rate of the state. The company then analyses all these aspects and after that decides what the insurance rate will be for the driver., if a state has high criminal offense rates then the possibilities of cars and truck stealing are greater.

The gender of the driver impacts a lot on the automobile insurance expense for any state, city, or area. Usually, we can say that a male teen motorist needs to pay $380 extra as compared to a female teen driver. Based on the insurance coverage carriers around the nation, have much tidy record and no to one at-fault mishap on record.

As a result, insurance coverage business discover female drivers much more secure customers than male drivers. On average, the female teen motorist pays $3180 for minimum coverage, while a male motorist pays $3975 for minimum coverage.

Adding a teenager daughter can increase your insurance coverage rates by $1098 each year. And this is much lower than the average insurance coverage expense for a male teenager driver. The factor behind this is; as per insurance carriers around the country, female drivers are much more secure as compared to male chauffeurs. However these rates differ for various vehicle insurance provider.

3 Simple Techniques For Best Car Insurance Buying Guide - Consumer Reports

Get as lots of discount rates as possible The best part of getting teen car insurance is you can get a trainee discount rate. Every company has its terms for trainee discounts. On average, the driver ought to have at least an average of B grade or greater to get certified.

And then you just need to compare the rates from all these companies to examine which one has the most inexpensive rates. By integrating the rates you'll get a better concept of how various companies charge for the exact same policy. Yes, each company can have a various rate for the same driver.

Insurance business link the automobile to either a beacon-like gadget or an app. Based on this data the insurance carrier can supply you a customized insurance coverage rate.

Include a teen motorist to the parent's policy The finest method to get the cheapest car insurance for brand-new motorists is to include them to their moms and dad's policy. There are some fantastic advantages of remaining in your moms and dad's policy.

The Single Strategy To Use For Should You Add Your Teen Driver To Your Car Insurance ...

Plus you'll likewise get other discounts like multiple automobiles discounts and even great and skilled driver discount rates. Integrating all these discount rates your insurance coverage rates can get reduced to almost 60 percent of your existing rates. If the parents have actually paid for the car then it is required to get an insurance coverage policy under the parent's name.

Avoid high-value vehicles for the teen motorists Yes, we know your teen kid or daughter is asking for that high valued high-end car. The insurance coverage rate for that vehicle can nearly be double that of any low-valued vehicle.

Once again this can affect your insurance rates. The actual cost value of that car will be low hence your insurance coverage company will offer lower insurance coverage rates for the vehicle. Can my teenager drive my vehicle if he or she is not listed on the policy?

If the person enters a mishap then the business can reject the claim. 2. Do teens require to get complete protection cars and truck insurance coverage? No, teen drivers can drive lawfully with the state's minimum needed protection. Full coverage insurance is recommended for teens to prevent huge repair work bills. 3.

Getting The Insurance For Teens - Country Financial To Work

The factor behind this is; as per the insurer around the country, teenager drivers have the highest involvement in substantial road accidents. Plus they get associated with negligent driving and DUIs. 4. Which is the very best company to purchase vehicle insurance for 17 years old? Providing the credit to one business will be unfair to other business.

And each business has a different coverage in their policy. Some may cover collisions at $1400 while some might cover just the minimum requirement is $1500. However the leading five car insurance business for teenager chauffeurs are; Allstate, Progressive, Erie, Nationwide, and USAA. 5. Is it much better to include the teen motorists to the moms and dad's policy? Including a teenager chauffeur to a parent's policy can be a clever choice.

Still, have some doubts about buying automobile insurance for teenager drivers? We have a professional team for you. Contact us with us today and go over all your inquiries.

https://www.youtube.com/embed/BjX79GsALd8

When shopping for the most affordable cars and truck to guarantee for a teen, you ought to consider a number of aspects in addition to the kind of automobile. A few of these factors include the teen's age, state of house, and gender. Most Inexpensive Cars And Trucks to Insure for Teenagers, These are the top 10 most inexpensive vehicles to guarantee for teenagers, including the typical annual car insurance cost: Mazda MX-5 Miata: $2640.

AboutThe 4-Minute Rule for Car And Auto Insurance Quotes Online - Usaa

It's unlawful in the majority of states to drive without protection and plus, you'll wish to be covered in case you enter into a mishap. Otherwise, you could end up paying countless dollars for damage that might've been covered. If you're captured driving without automobile insurance in a state where it's required, you could end up with tickets and fines, or you could lose your driver's license and car registration.

So if you trigger an accident and you don't have vehicle insurance coverage, you could be taking a look at countless dollars in medical costs or automobile repairs for the other celebration. Just how much more do brand-new drivers spend for cars and truck insurance? Car insurance premiums are essentially based upon just how much of a risk you would be to guarantee.

The 5-Minute Rule for Tips For First-time Car Insurance Buyers - Bankrate

For a full-coverage policy, her typical annual rate was $1,416, based upon quotes from three major insurance companies. When a teen driver was added to her car insurance policy, the average annual rate increased to $3,204 that's over two times as much as what she would be paying for herself alone.

Sign up with an existing vehicle insurance coverage, Keep your rates as low as possible by adding yourself to an existing automobile insurance coverage, assuming you cope with other drivers. Their premiums might be higher if you're included, however it will still be more affordable than getting a policy by yourself.

What Does California New Car Insurance Grace Period: Why It's Important Mean?

2. Maintain a clean driving record, As a new chauffeur, you may not have a driving history yet, however driving safely for many years can More helpful hints conserve you in the long run; most business tend to look at the last 3-5 years of your driving history when calculating your rates, so accidents and infractions ultimately fall off your record.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/african-teenager-in-car-with-father-74956310-5c17c08246e0fb0001e03814.jpg)

5. Shop around for automobile insurance, The finest method to ensure you're getting the most affordable rates on car insurance coverage is to go shopping around and compare quotes from multiple carriers. When you have actually gotten sufficient quotes, you can compare them side-by-side and select the carrier that offers the many coverage at the most inexpensive price.

Unknown Facts About Cheap Car Insurance For Teens And Young Drivers - Compare ...

Cars and truck insurance companies can deny you protection for any factor other than those forbidden by law. A history of risky driving and tickets and infractions are some of the main reasons a cars and truck insurance coverage company may reject you protection.

Find The Built-In Savings If you're relocating to a huge city, space-saving compact automobiles can be a fantastic alternative due to the fact that they're simple to park and can provide excellent fuel economy in time. The opportunity to save money on gas long term can make hybrid and electric automobiles appealing choices, says Crane.

What Does Getting Car Insurance For A First-time Driver - The Balance Do?

"These vehicles tend to be quite pricey when they're new," she says, "so it may be best for those on a budget plan to search for utilized models." 4. Get Insurance! While you're searching to compare vehicle insurance, bear in mind the lots of elements that can assist you get a less expensive vehicle insurance coverage premiumand lower your total monthly automobile expenditures.

It's an absolute requirement. What is insurance? Insurance coverage is an agreement in between you and your insurer in which you pay the insurer a particular quantity of cash and, in return, the company will secure you from major financial losses due to an accident for a provided amount of time.

Some Known Details About Do You Need Insurance Before Buying A Used Car?

How can the car insurer cover the expense of claims and remain in service? It's simple. Insurers group individuals together utilizing differing criteria such as driving record, age, gender, kind of automobile, miles driven each year and where they live. Statistically, the insurer knows how numerous members of your group will enter into mishaps.

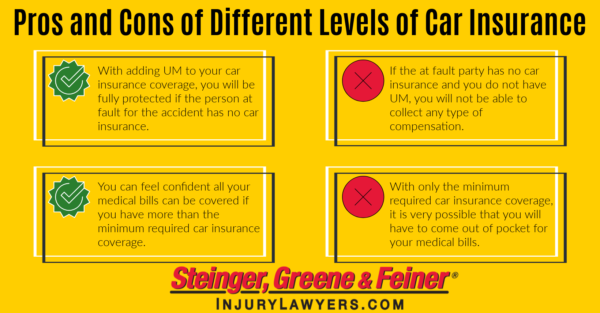

What type of automobile insurance coverage should I get? This depends upon a variety of elements. Certainly, you want to get liability protection to secure yourself versus claims in case you cause an accident. Nevertheless, if your vehicle is older, you might not wish to get collision insurance considering that you might pay more for the premiums than the vehicle is worth.

Top Guidelines Of Cheapest (& Best) Car Insurance For First-time Buyers & Drivers

Below is a listing of the various kinds of coverages a policy might contain and what they do. pays medical costs of other people hurt in a mishap that you caused. It likewise covers the expense of lawsuits if you should be sued. spends for other individuals's residential or commercial property damaged in a mishap for which you are responsible.

There are usually limits defined in the policy. pays your medical costs if you're injured in a mishap triggered by someone who has no insurance coverage or inadequate insurance to cover the costs. In some states, it will likewise cover damage to your residential or commercial property. spends for damage to your automobile when you are at fault in an accident involving another lorry or some other item.

How To Register And Insure A Purchased Vehicle In Alberta Things To Know Before You Get This

Exists more than one type of insurance system? There are 2 fundamental kinds of insurance coverage systems states can choose for their residents: or. In a tort system, the insurer of the person who triggered the accident is accountable for paying for property damage, bodily injuries and other economic costs.

High-performance vehicles are appealing, however not just are they pricey to run, they're expensive to guarantee. Choose a car with an excellent security record, that's less costly to fix and that's not on the vehicle thieves' most-wanted list. The deductible is the quantity of a claim that you pay. Usually, it's $100, $200 or $500.

The Greatest Guide To How To Shop For Car Insurance To Get The Best Deal - Business ...

What Is a Newbie Driver and Does Age Matter? A newbie motorist is someone with no driving experience.

It is common for individuals to wait up until their adult years to get their license in areas with exceptional public transport options. But no matter the factor, novice chauffeurs of any age can anticipate to pay more for car insurance coverage. A newbie chauffeur who gets their license at 40 will pay less than a chauffeur who gets their license at 18, they will still pay considerably more than a 40-year-old motorist with 20 years of driving experience.

Fascination About Insurance Tips: 10 Steps To Buying Car Insurance - Edmunds

WHY TRUST MONEYGEEK? Due to the fact that we have cool glasses! All jokes aside, it is very important that you can trust what you check out. The insurance expense data we gathered includes real quotes from real insurer and is upgraded on a constant basis as information modifications. See our editorial requirements or methodology at the bottom of the page for additional information.

A lot of first-time motorists get their license after the age of 16, so Money, Geek determined the cheapest insurance coverage rates based upon an 18-year-old first-time chauffeur. The 2 most affordable companies for state minimum liability protection are State Farm, with a typical yearly premium of $1,771, and GEICO, with an average yearly premium of $2,035.

Getting The The Guide For First Time Car Insurance Buyers - Ball State ... To Work

Why First-Time Drivers Pay More for Vehicle Insurance, Like any ability, driving is something that people tend to get better at with experience. Unskilled motorists are a greater risk for insurance business, which implies they charge higher rates to compensate for the possibility of extra claims.

Each company has somewhat various standards, so consult your insurance coverage company to see if they offer this discount and what grades you'll require to earn it. Avoiding mishaps, speeding tickets and other acnes on your driving record are a few of the most crucial methods to keep your insurance costs low.

A Biased View of How Soon After Buying A Car Do You Need Insurance?

EXPAND ALLWhat business has the most affordable insurance coverage for first-time drivers? State Farm has the cheapest insurance coverage for first-time motorists, followed carefully by GEICO. This is based on a sample motorist, which suggests there could be other companies that are available in at more budget-friendly rates in your specific situation. It is crucial to get numerous quotes based on your personal history, your location and any discount rates that might use to you to get the best cars and truck insurance coverage for newbie buyers.

You can likewise contact each business directly or reach out to an insurance coverage agent in your area to get quotes for car insurance. Just how much is automobile insurance for first-time chauffeurs? Car insurance rates will depend on your specific circumstance, the levels of protection you pick and your insurance provider.

What Does Compare Insurance For First Car - Moneysupermarket Mean?

https://www.youtube.com/embed/_1jQ4LbeaA4That very same driver selecting the most pricey protection might pay anywhere from about $6,575 for minimum protection to around $12,797 for the complete protection choice. Can you purchase car insurance coverage from an automobile dealership? It's possible to buy insurance through a vehicle dealership, however you will not have the chance to compare prices if you do so.

AboutThe Single Strategy To Use For Buying Your First Car: A Guide For Teens (And Everyone Else!)

You do not desire to throw more stuff at them by providing them a vehicle that may offer them fits. Something they desire, Safety and duty is by far the most crucial thing when choosing a cars and truck for a teenager.

Not only is that a great thing to do, however if a teenager likes their car, they'll be most likely to treat it properly. Even if you're just letting them pick between 2 or three designs or pick a color, that can provide a sense of ownership, responsibility, and pride.

If you factor all of these things, you'll be able to find the right very first automobile for your teenager. Key Takeaway Given that teens have a greater accident rate, multiple factors play into computing its overall security and insurance risk. The very best cars and trucks for teenagers You'll probably a desire a midsized car or SUV to stabilize security and drivability for your teen.

Getting My Safe Driving For Teens: Medlineplus Medical Encyclopedia To Work

Jerry does all the work of setting up your brand-new vehicle insurance, and will even break up with your old company for you.

Here are some questions and responses about teenagers and vehicle insurance: Kathy Bernstein Harris, senior supervisor for teenage driving initiatives at the National Security Council, a not-for-profit, stated that some insurance companies offered discount rates for students who get great grades (although it's not always clear that being a great trainee correlates with much safer driving).

Ms. Harris said the best method to reduce claims and hold costs down and keep your kid safe was to set guidelines and hang around driving with teens and training them along, even after they pass their driver's license tests. "Just getting a piece of plastic does not mean they are completely prepared for the open roadway," she said.

A Biased View of How To Save Money On Teen Car Insurance - Dave Ramsey

Ms. Harris recommends that parents not buy a brand-new cars and truck particularly for their brand-new teenage chauffeur or, if they do, that they make it clear that the cars and truck is the household's vehicle, instead of the teenage driver's individual automobile. By making the car a "household" vehicle, she said, parents can much better set guidelines for its use and talk about where their kid is headed and who is expected to go along.

When it comes to teen chauffeurs and vehicle insurance coverage, things get complicated-- and expensive-- quickly. A parent including a male teenager to a policy can anticipate car insurance coverage rate to balloon to more than $3,000 for complete protection. It's even higher if the teen has his own policy.

Now, that we've evaluated those sobering realities, let's guide you through your vehicle insurance coverage buying. We'll take a look at discounts, choices and unique circumstances-- so you can discover the finest car insurance coverage for teenagers. Despite the fact that the right answer is generally to add a teen onto your policy to alleviate a few of the cost, there are other choices and discounts that can conserve money.

The Buzz on Ways To Save - Auto-owners Insurance

In the end, you'll require to compare vehicle insurance coverage estimates using our quote contrast tool to see which business is best for you. KEY TAKEAWAYSAccording to the federal Centers for Disease Control and Prevention, the worst age for mishaps is 16. If the trainee plans to leave a car in the house and the college is more than 100 miles away, the university student might qualify for a "resident student" discount rate or a trainee "away" discount.

This is called a named exemption. Starting: A simple guide Opportunities are that your car insurance provider will call you. How does the company know? It most likely asked you for the names and birthdays of all the children in your house when you first signed up for your policy.

If you don't get the call, alert your provider as soon as your teen gets a student's authorization to talk through your choices and to provide yourself time to compare automobile insurance provider. In general, permitted drivers are immediately covered as a part of the parent or guardian's policy with no action required on your part.

The smart Trick of Car Insurance For Teens - Root Insurance That Nobody is Talking About

Use our discount guide below so you're not in the dark. All 50 states and the District of Columbia now have a Graduated Motorist's License (GDL) system, according to the Insurance coverage Institute for Highway Safety (IIHS). GDL programs save lives. A study by the IIHS found states with more powerful finished licensing programs had a 30% lower deadly crash rate for 15- to 17-year olds.

It still includes a hefty expense, however you can certainly conserve if you pick the finest cars and truck insurance provider for teens. We can assist. How much does it cost to add a teenager to vehicle insurance? Let's get down to numbers. The expense of adding a teenager to your vehicle insurance policy varies based on a number of factors.

The factor behind the walkings: Teenagers crash at a much higher rate than older motorists. They have a crash rate twice as high as chauffeurs that are 18- and 19-year-olds.

Car Insurance For Young And Teenage Drivers - Policygenius for Dummies

Simply ensure your teen isn't driving on a complete license without being formally included to your policy or their own. That would be dangerous. If my teenager gets a ticket, will it raise my rates? Yes. Once together on the exact same policy, all driving records-- including your teen's-- affect premiums, for much better or worse.

To understand how a moving infraction will impact your rates, we ran a research study and discovered that the extra cost might run from 5% to as high as 20%. Teenager buying their own policy, Can a teen buy his/her own insurance? Yes. Companies will offer directly to teens.

That indicates a parent might have to co-sign-- and it's seldom less expensive. Your teenager will likely have a greater premium compared to including a teenager to a parent or guardian policy. There are cases where it might make sense for a teenager to have their own policy.

What Does Car Insurance For Teenagers: What The Guys Need To Know Mean?

On a single strategy, all chauffeurs, including the teen, are insured versus all automobiles. The teen aspires to be economically independent. Vehicle insurance is various for a first-time vehicle insurance coverage purchaser, but it's a fun time to begin a relationship with an insurance provider. Just how much is vehicle insurance for teenagers? Like we have actually said, teen automobile insurance coverage is costly.

Young chauffeurs are much more most likely to enter automobile accidents than older chauffeurs. The risk is highest with 16-year-olds, who have a crash rate two times as high as 18- and 19-year-olds. That threat is reflected in the typical vehicle insurance rates for teenagers:16-year-old - $3,98917-year-old - $3,52218-year-old - $3,14819-year-old - $2,17820-year-old - $1,945 Rates not only depend upon age, however the business you select.

https://www.youtube.com/embed/VmFdoCJVJNQ

You could receive a discount rate around 5% to 10% of the student's premium, but some insurers promote up the 30% off. The typical trainee away at school discount is more than 14%, which is a cost savings of $404. An easy way to lower automobile insurance coverage premiums is to raise your deductible.

AboutThe Of Total Loss Threshold By State - Appraisal Engine Inc

That way, you'll have an automobile that hasn't been significantly harmed and is likewise one that automobile insurer enjoy to insure. You can still compare rates to find the best offer and the only thing that might have an effect on your last rate is the fact that you were associated with a serious mishap.

You can talk to a cars and truck insurance coverage agent to learn when the ideal time to get space coverage will be and what kind of policy will be your finest choice. As you begin searching for a replacement vehicle, it's a good idea to get automobile insurance coverage quotes on the vehicle you desire prior to you sign the purchase arrangement.

Crash protection can provide you some comfort knowing that your vehicle insurance coverage company will step in and spend for most or all of the costs connected to your accident, consisting of a complete replacement of your lorry. As distressing as it can be to total your automobile, you can return on your feet and even buy a replacement car soon after your event.

The 6-Second Trick For Auto Insurance Faqs - Insure U

In the case of a serious vehicle accident, where more than one celebration was involved and there were several automobiles that were harmed, it might assist to get support from a car accident attorney so they can guide you through the process of filing precise cops reports, collecting relevant information for insurance provider, and handling any negotiations or conflicts that develop in between you and your insurance company.

Entering a vehicle accident can be a significant headache. It's even worse if your cars and truck is damaged beyond repair. Amounted to cars and trucks are typically covered by vehicle insurance coverage, so you should get a payout to buy a new one. However the quantity of cash you'll get varies based upon a couple of aspects.

In this post, we'll help you understand what occurs after your vehicle is amounted to, and just how much money you'll get to replace it. What does it imply when an automobile is amounted to? Initially, let's talk about what certifies as a totaled cars and truck. From an insurance viewpoint, a car is amounted to when it will cost more to repair it than its existing worth.

The Definitive Guide for How Much To Buy Back Totaled Car From Insurance

Every state has its own policies about what constitutes an overall loss, as Adams indicates:"Various states have various laws about when to state an automobile a total loss. For circumstances, it might be when the expense to repair the damage is more than 75% of its real cash value before the accident.

How is ACV calculated? Your insurance business computes your car's actual cash worth based on factors like the age of the automobile, its mileage, the claims history, the make and design, and any upgrades you have actually made over the years. These are all variables that influence devaluation, and efficiently effect your payout quantity.

Nevertheless, some motorists have an insurance coverage that uses replacement cost value (RCV) to reimburse you after a loss. Unlike an ACV policy, an RCV policy compensates you for the loss without devaluation factored in. So if your vehicle is totaled and you have an RCV policy, you'll get payment for the complete value of the automobile, regardless of its age, condition, and so on.

Fascination About Insurance Says Your Car Is Totaled; Now What? - Morris Bart

This type of protection will pay for the expense of a brand new cars and truck, of the very same make and model, if your cars and truck is declared an overall loss. Ultimately, new vehicle replacement protection provides you the greatest payout after a serious accident. New cars and truck replacement is an optional protection, meaning it doesn't come basic with many automobile insurance coverage.

Having brand-new car replacement coverage simplifies the value estimation procedure, as you'll just get a check for the price tag of a new model if your old one is amounted to. What if you have a lease or loan? Many individuals select to lease their car or finance a purchase with a loan.

Can insurers deduct for any damage or rust that existed before the loss? Yes. Deductions for previous damage or rust must be made a list of with specific dollar quantities. The quantity by which the resale worth of the car increases by removing the previous damage is the quantity the insurer can subtract from your overall loss settlement.

Little Known Questions About How To Determine Salvage Value If You Want To Keep Your ....

The cash value of your cars and truck is based on what similar cars are costing in the Phoenix area. Accepting a money offer from the insurance provider might help you purchase another automobile similar to what you had before. There is a good possibility the very first deal from insurance is lowand that you could in fact get more.

When you're prepared to move on with your claim, please contact our office to organize a totally free preliminary assessment.

, which cover damage to your automobile) you'll be paid the worth of your vehicle prior to the crash that totaled it, minus whatever deductible you owe.

What Does What Happens When Your Car Is Totaled? - Progressive Do?

If you feel your insurance provider has undervalued your cars and truck after it was amounted to and you're owed more than they're offering, you might be able to dispute the ACV they came up with. Key Takeaways If your car is a total loss after an accident, your insurance coverage business will pay out the vehicle's ACV, or real cash value, Insurance companies usually aren't transparent about how exactly they calculate ACV, however it's based on a mix of aspects, If you think your insurance coverage business's appraisal is too low, you may be able to contest their deal by discovering similar automobiles for sale in your location What is ACV?

https://www.youtube.com/embed/JxiiZ7zARak

Because your insurer will consider usage, previous mishaps and basic wear and tear to your automobile, the ACV they create might be hundreds, or perhaps countless dollars less than you spent for your automobile. Even if you're a precise owner who's taken terrific care of your car, cars depreciate in value the moment you drive them off the lot, so that devaluation will be taken into consideration too.

AboutTeen Safe Driving Program & Discount - American Family ... Can Be Fun For Everyone

Notification how the suggestions isn't "save $1,000" or any conclusive number. The quantity you need to save depends upon the rate of the cars and truck. To understand how you need to save for a down payment, you need to set a cost cap. It's normally recommended that moms and dads cap their costs limitation at around $10,000 for their teenager's very first automobile, and most stick to used ones.

They're thought about minors and lawfully can't get in a loan agreement or have actually an automobile signed up in their name. Teenagers over the age of 18 can get a vehicle loan, but their credit history may not be the best, making it challenging for them to go it alone. Buying a Vehicle for a Minor Considering that minors can't get in a loan contract, you require to buy your brand-new, 16-year-old motorist their very first vehicle.

If you choose this route, then you can list the 16-year-old as a chauffeur. Some parents match what their teenagers save, like a 401k. If your kid conserves $1,000, then you match it with another $1,000. That would be a big enough deposit for a $10,000 automobile. It's most likely to put a cap on how much you'll match, though, in case your teenager conserves a lot and you can't match it when the time comes! Lots of individuals get in into casual household contracts with their teenagers till they turn 18.

Once they turn 18, you might "sell" them the car and they can get it registered in their own name. Vehicles for Teenagers Over 18 Considering that younger customers typically do not have the longest credit history, their credit history may not be the very best. Borrowers without any credit tend to have less than typical credit history, which can make it hard for them to get in a car loan alone.

Examine This Report about Adding A Teen Driver Can Spike Your Family Premium More ...

If they make all the payments on time, both of you can end the loan with much better credit history. If it's dealt with well, they may not need a cosigner for their next loan because their credit report has actually improved. No Credit Auto Loans No credit debtors may have difficulty finding financing for their very first auto loan.

Whether you're going to fund your teen's very first car yourself, or you need to act as their cosigner, not everyone has the very best credit. If you remain in this boat, you might need the assistance of a subprime lending institution. These lending institutions consider more than just your credit score when you make an application for a vehicle loan.

We understand that getting a drivers license can be stressfulthat's why we do whatever we can to assist our drivers ed students through the procedure in a clear and straightforward method. For many, buying a first car can be even worse. It suffices to make some teenagers wait to end up being a licensed driver.

While some lending institutions offer loans with an APR of 3% or less, rates this low are typically scheduled for individuals with exceptional credit report; anticipate yours to be approximately two times as much. Alternatives to Purchasing a Vehicle, Leasing a Lorry, Can't afford a large deposit? You may wish to consider a lease.

The Ultimate Guide To Teen Drivers - California Dmv

You pay a specific amount every month to utilize it, however at the end of the agreement the automobile need to be returned to the dealership. For no down payment and the exact same monthly payment, drivers can typically manage a more expensive automobile under a lease. On the other hand, with a lease, the vehicle is not yours and you will not get anything for it when it's time for a new one.

By spending some time looking into prior to you purchase, you'll have a much better possibility of discovering a car that you can manage and meets your requirements. Are other family members planning to drive your vehicle or get rides from you? What features do you require your car to have?

Offer severe consideration to the concern of whether you actually need an automobile of your own, specifically if you're unsatisfied by the choices readily available at your budget plan. It might be much better to wait and conserve for something better. Where to Find Automobile Listings, While you can discover car listings in the paper and other free regional guides, the majority of the very same listings can be discovered online with more detailed information.

Action 3: Choose on a New or Utilized Car, One huge decision you'll have to make is whether you want to buy a new brand-new automobile a used carAutomobile Keep in mind these suggestions for examining a car you're thinking of buying: Always inspect out a car throughout the day. Most Inexpensive Cars And Trucks to Guarantee for Teens, These are the leading 10 most inexpensive automobiles to insure for teenagers, consisting of the average annual cars and truck insurance cost: Mazda MX-5 Miata:$2640.

AboutEverything about Totaled Car Guide: Key Things To Know In 2021 - Wallethub

You can speak to a vehicle insurance coverage representative to learn when the ideal time to get space protection will be and what type of policy will be your finest choice. As you begin looking for a replacement car, it's a great idea Find more info to get cars and truck insurance coverage quotes on the cars and truck you want prior to you sign the purchase arrangement.

Collision coverage can provide you some peace of mind understanding that your automobile insurance coverage business will action in and pay for the majority of or all of the costs related to your accident, consisting of a complete replacement of your lorry. As upsetting as it can be to total your automobile, you can return on your feet and even store for a replacement lorry soon after your incident.

When it comes to a serious cars and truck mishap, where more than one celebration was involved and there were multiple cars and trucks that were harmed, it may assist to get assistance from a car mishap legal representative so they can assist you through the procedure of filing accurate police reports, gathering pertinent details for insurance provider, and managing any settlements or disputes that occur in between you and your insurance provider.

When Is A Car Considered Totaled In Washington State? - Max ... - The Facts

Getting into a car mishap can be a significant headache. It's even worse if your cars and truck is harmed beyond repair. Amounted to cars are normally covered by automobile insurance, so you ought to receive a payout to purchase a new one. However the amount of cash you'll get differs based on a couple of elements.

In this post, we'll assist you comprehend what takes place after your cars and truck is totaled, and just how much cash you'll get to replace it. What does it imply when a car is totaled? Initially, let's speak about what certifies as a totaled vehicle. From an insurance coverage point of view, an automobile is totaled when it will cost more to fix it than its existing value.

Every state has its own policies about what constitutes a total loss, as Adams indicates:"Different states have different laws about when to declare a lorry a total loss. It might be when the expense to fix the damage is more than 75% of its real cash value before the mishap.

9 Simple Techniques For What Happens When Your Car Is Totaled? - Usaa

How is ACV computed? These are all variables that affect depreciation, and effectively effect your payout quantity.

Some chauffeurs have an insurance policy that uses replacement expense value (RCV) to reimburse you after a loss. Unlike an ACV policy, an RCV policy reimburses you for the loss without depreciation factored in. If your vehicle is totaled and you have an RCV policy, you'll receive payment for the complete worth of the automobile, regardless of its age, condition, and so on.

This kind of protection will pay for the expense of a brand new vehicle, of the very same make and model, if your automobile is declared an overall loss. Eventually, new vehicle replacement protection gives you the biggest payout after a serious mishap. New cars and truck replacement is an optional coverage, suggesting it doesn't come standard with many automobile insurance plan.

How When Is A Car Considered Totaled In Washington State? - Max ... can Save You Time, Stress, and Money.

Having new cars and truck replacement coverage simplifies the value estimate procedure, as you'll simply get a check for the sticker rate of a brand-new model if your old one is totaled. What if you have a lease or loan? Lots of people select to rent their automobile or finance a purchase with a loan.

Can insurance providers subtract for any damage or rust that existed prior to the loss? The quantity by which the resale worth of the automobile increases by getting rid of the previous damage is the quantity the insurance business can subtract from your total loss settlement.

The money worth of your cars and truck is based on what comparable cars are offering for in the Phoenix location. Accepting a money offer from the insurance business may help you buy another automobile similar to what you had previously. Nevertheless, there is a likelihood the first offer from insurance coverage is lowand that you could in fact get more.

The smart Trick of Auto Insurance Faqs - Insure U That Nobody is Talking About

When you're prepared to move forward with your claim, please contact our workplace to arrange a complimentary initial consultation.

, which cover damage to your automobile) you'll be paid the value of your cars and truck before the crash that totaled it, minus whatever deductible you owe.

If you feel your insurance company has actually underestimated your automobile after it was amounted to and you're owed more than they're using, you may be able to challenge the ACV they came up with. Key Takeaways If your vehicle is an overall loss after a mishap, your insurance provider will pay the vehicle's ACV, or actual cash worth, Insurance provider generally aren't transparent about how precisely they compute ACV, however it's based on a combination of elements, If you believe your insurance coverage business's evaluation is too low, you may be able to dispute their deal by discovering equivalent automobiles for sale in your area What is ACV? The ACV, or actual cash value of your cars and truck is the amount your car insurance provider will pay you after it's taken or totaled in an accident.

The Of What Happens When Your Car Is Totaled?

https://www.youtube.com/embed/bHVijTzGaAUDue to the fact that your insurer will take into consideration use, past mishaps and basic wear and tear to your automobile, the ACV they develop might be hundreds, or even thousands of dollars less than you spent for your automobile. Even if you're a meticulous owner who's taken excellent care of your car, automobiles diminish in value the minute you drive them off the lot, so that depreciation will be thought about too.

AboutWhat Happens If You Have A Car Accident Without Insurance? Can Be Fun For Anyone

It is legal to drive without automobile insurance Virginia, doing so can have downsides. Every chauffeur should either buy insurance prior to registering or running a motor vehicle or pay an unique cost to drive uninsured. If you enter into a mishap without insurance, it can make the vehicle claim procedure more complicated.

What Are the Vehicle Insurance Requirements in Virginia? Prior To the Virginia Department of Motor Cars (DMV) will enable you to register your vehicle or get license plates, you need to verify that you have purchased at least the minimum required amounts of automobile insurance coverage. Otherwise, you will have to pay the uninsured motor car charge to register the lorry without insurance.

The 25-Second Trick For Driving Without Auto Insurance: Don't Risk It! (2021 Update)

Since Virginia is not a traditional no-fault state, you have the choice of submitting an injury claim against a chauffeur for the damages you suffered in a mishap. If you choose for fault-based insurance coverage, the at-fault motorist will pay for your damages rather of your own insurance provider. This could put you at threat, however, if the other motorist does not have insurance coverage.

Even if you show that you have insurance later to the court, you might still have to pay court fees. If you get charged with driving without insurance coverage and you haven't paid the fee, you can ask for a hearing to make a case for why the state shouldn't punish you.

The Penndot Fact Sheet - Insurance Law PDFs

Typical factors for letting your insurance coverage lapse are if you've been in prison, in the military, or hospitalized for a long period of time. What We Advise To get the most protection on your own in the event of an automobile accident, we recommend you carry car insurance coverage with the optional PIP policy attached to it.

There are a lot of reasons individuals think about driving without vehicle insurance: It's not that big of an offer, I'm not injuring anybody. Driving uninsured is a huge deal.

Not known Incorrect Statements About Do You Need Auto Insurance If You Don't Own A Car?

And driving without insurance coverage is actually, truly foolish. That's because car insurance coverage is required in every single state other than New Hampshire and parts of Alaska. What Takes place if You're Caught Driving Without Insurance Coverage?

The one thing they have in typical? Now, most states do offer grace for honest mistakeslike if you forgot your new proof of insurance coverage cards on the cooking area counter and just occurred to get pulled over that day.

What To Do If You're Hit By An Uninsured Or Underinsured Driver - Questions

But if you really do not have insurance? You're looking down the barrel of some beautiful significant punishments. Fines The fines for driving without insurance differ from state to state, however a common quantity is $500 to $1,000 the very first time you get busted. The typical annual expense of insurance is $644 for liabilityso if you need to pay simply one fine, you have actually spent just as much, if not more, than if you had simply gotten insurance coverage in the very first place.1 And for every offense after that, the fine goes upsometimes to thousands of dollars.

Here's what they suspend and why: Registration, so you can't keep driving your uninsured lorry Motorist's license, so you can't drive any lorry Some states might suspend both your license and registration. You may even have to return your suspended license plate or chauffeur's license to the local Department of Motor Cars.

Mandatory Insurance - Faq - Adot - The Facts

(Some states, like Delaware, also charge you a cost for each day that your registration is suspended.2) Many states require you to insure your automobile and get an unique document called an SR-22 to prove that you're covered before they'll renew you. Impoundment Typically, the police officer who captures you driving without insurance can have your automobile towed away and secured.

When you go to get your cars and truck back, be prepared to break out your wallet. Most take lots charge you to launch your vehicleand then charge additional fees for every day that it sat in their parking lot. Imprisonment That's rightyou can go to prison for driving without insurance. Jail time varies from a few days to a few years depending on where you live and the number of times you've broken the law.

The Buzz on 5 Reasons Drivers Don't Buy A Car Insurance Policy - Insurify

The majority of people do not have a million dollars to dish out after a mishap. You know who does? Insurance provider. That's why insurance is so criticaland why it's needed by law in the majority of the U.S. Its whole purpose is to protect you and individuals around you from monetary mess up after an accident.

You'll face your state's charges for driving without insuranceand then some. (The majority of states have laws that make the penalty for driving uninsured worse if you get in an accident.) We deal with the accident itself. When the Mishap Is Not Your Fault The at-fault chauffeur will probably have to pay for the damage to your cars and truck and any medical treatment you needas long as they have insurance.

Indicators on What To Do If You're Hit By An Uninsured Or Underinsured Driver You Should Know

You're likewise on your own for expenditures their insurance will not cover. When the Mishap Is Your Fault Again, you're dealing with a fine, suspensions and possible jail time.

They'll take a look at your circumstance and search with multiple insurance providers to get you the very best protection based on your automobile and financial objectives. Best of all, they do this at no additional cost to youso you can simply pay your insurance coverage premium and take pleasure in the open roadway.

Indicators on What If I Am In A Car Accident And Don't Have Insurance? You Need To Know

There are 2 things that can occur to you. If the mishap resulted in a claimed physical injury, death, or more than $1,500 in declared damages, the DOT may-- if you were the individual driving, suspend your drivers license, OR if somebody else was driving your cars and truck, suspend your ability to get a new registration.

https://www.youtube.com/embed/w3_6ujtW61U

If they win, and you do not pay the judgment, they can ask that your motorists certify be suspended. The rest of this post will offer you some concepts regarding what you can do if you find yourself in either or both of these circumstances after a mishap. When an accident is reported to the DOT where damages are not totally covered by your insurance coverage, you may get a notification from DOT that says your license or registration will be suspended if you don't pay "security." This means that you might get your license back by paying the total the other side claims would cover the damages.

AboutWhat Does Pay Insurance Fines Online - Georgia Department Of Revenue Mean?

Where can I get details on service center? To discover a repair shop in your area, you can access your claim online. If you are qualified for online scheduling, you will have the ability to look for maintenance stores near you. If you are not eligible to arrange online, a Claims Service Representative can assist you discover a shop.

Discounts Frequently asked questions: Exists a discount rate for being accident-free? Safe driving definitely has its benefits. You might be qualified for a good motorist discount as long as you have actually not had any accidents, or moving offenses, that have led to a premium surcharge. View your existing discounts to see if you are getting a good driver discount.

Getting A Driver License: Mandatory Insurance - Dol.wa.gov - The Facts

It's not easy keeping in mind all of your passwords and user IDs. That's why we've made it easy to retrieve them.

Your Home Insurance Plan Might Be Cancelled If you don't make a payment within the grace duration, your insurance provider deserves to cancel your policy. If your coverage lapses, you won't have any security for your house and ownerships and you'll need to take on the expenses if the worst occurs.

Some Of Car Insurance For First-timers

Worse, your lender might choose to foreclose on the home. Yes, you might lose your home if you don't pay your insurance coverage premiums. Your Credit Report Could Take a Dive If you have outstanding property owners insurance premiums, your provider could send out the debt to collections. This will have a negative effect on your credit ranking you can anticipate your score to go down.

But, it's best to look around while you're still present on your homeowners insurance that way, it will be much easier to change to another carrier to get more affordable protection. What if that ship has sailed? An independent representative can still help you find the protection you require at the lowest possible price, but you might have fewer choices with a lapse in your house owners insurance coverage.

The Only Guide to What Happens When My Friend Crashes My Car? - Farmers ...

Our highly skilled team can compare policies from lots of providers to discover the very best offer. You'll be in great hands with the Four Seasons Insurance group contact us to explore your coverage alternatives, and you'll leave with the house insurance you require, at a price you can afford.

If your automobile is totaled or taken before the loan on it is settled, gap insurance will cover any distinction in between your car insurance payment and the amount you owe on the vehicle. If you're financing a car purchase, your loan provider might require you to have space insurance for specific types of cars, trucks or SUVs.

The Greatest Guide To Insurance Compliance Faqs - Ct.gov

Tip Some dealerships use space insurance coverage at the time you acquire or lease a lorry though it's essential to compare the cost to what standard insurers may charge. How Gap Insurance Works It's fairly easy for a driver to owe the lender or leasing business more than the cars and truck is worth in its early years.

In regards to filing claims and car valuations, equity must equate to the existing worth of the car. That value, not the price you paid, is what your routine insurance coverage will pay if the car is wrecked. The problem is that cars diminish quickly during their very first number of years on the roadway.

Fascination About Pay Insurance Fines Online - Georgia Department Of Revenue

You still owe $20,160. One year later, the cars and truck is trashed and the insurance business writes it off as a total loss. According to your auto insurance plan, you are owed the full current worth of that vehicle. Like the typical cars and truck, your automobile is now worth 20% less than you spent for it a year ago.

Your collision coverage will reimburse you enough to cover the impressive balance on your auto loan and leave you $2,240 to put down on a replacement car. What if your cars and truck was one of the models that do not hold their value? Say it's depreciated by 30% considering that you purchased it.

What Happens After A Car Accident With No Insurance Can Be Fun For Anyone

This isn't as alarming as it sounds. If you put just a little money down on a purchase and pay the rest in little month-to-month installations spread out over five years or more, you don't immediately own much of that house or car free and clear. As you pay down the principal, your ownership share expands and your debt shrinks.

You Might Have The Ability To Avoid Space Insurance Coverage If ... If you're still settling your vehicle, you almost certainly have accident coverage. You 'd be playing with fire without it, and, in any case, you're most likely required to have collision coverage by the terms of your loan or lease contract. You made a down payment of a minimum of 20% on the car when you bought it, so there's long shot you will be upside-down on your loan, even in the very first year approximately that you own it.

The 25-Second Trick For What To Do After A Car Accident If You Don't Have Insurance

The average brand-new auto loan remains in excess of $32,000. The typical loan term is now 69 months. You would not dream of avoiding crash insurance coverage on that automobile, even if your loan provider allowed you to do it. However you may consider gap insurance coverage to supplement your collision insurance coverage for the duration of time that you owe more for that car than its real money value.

This is most typically the case in the first couple of years of ownership if you put down less than 20% on the car and extended the loan payment term to five years or more. A glimpse at a Kelley Blue Book will inform you whether you require gap insurance coverage.

Do You Really Need Gap Insurance? - Investopedia Fundamentals Explained

How Much Does Space Insurance Coverage Expense? You can include space insurance coverage to your regular extensive auto insurance coverage policy for just $20 a year, according to the Insurance coverage Industry Institute. That stated, your cost will differ according to the normal laws of insurance. That is, your state, age, driving record, and the real design of the vehicle all play a part in prices.

Some are needed by state law to offer it. However dealerships generally charge significantly more than the major insurer. Typically, a car dealership will charge you a flat rate of $500 to $700 for a space policy. So, it pays to search a bit, starting with your existing car insurer.

7 Simple Techniques For What Happens If You Don't Pay Your Car Insurance?

Another benefit of opting for a big-name carrier is that it's simple to drop the gap protection once it no longer makes monetary sense. Space Insurance Frequently Asked Questions Here are some quick answers to the most commonly-asked questions about space insurance. Is Space Insurance Coverage Worth the Cash? If there is at any time during which you owe more on your automobile than it is presently worth, space insurance coverage can absolutely deserve the cash.

https://www.youtube.com/embed/ihPney4MSxE