Unknown Facts About Defining Car Insurance Deductibles

As long as a motorist does not enter a crash in less than a year, they would certainly be better off. The value of the car, If a car isn't worth much, it might not pay to have protection with a high deductible (auto). Claim a motorist opts for collision protection with a $1,000 deductible and also their lorry is just worth $1,000.

In this instance, the motorist would be much better off discarding crash coverage entirely. How to prevent paying an automobile insurance deductible, The most effective method to stay clear of paying a vehicle insurance policy deductible is to stay clear of crashes, burglary, or damages. Method protective driving, follow the regulations of the roadway, follow the speed limitation, and also stay clear of driving in poor weather condition.

People can likewise pick a plan without deductible, albeit at a higher expense. Or they can authorize up for a disappearing or vanishing deductible with insurance providers who offer it. This will reduce the amount of the insurance deductible by a collection amount throughout each time period the vehicle driver is without mishaps - prices.

On the various other hand, if your insurance deductible is $100, then you will just pay $100 prior to the insurance business pays the remaining $3,900. As you can see, a greater deductible ways you pay more out-of-pocket as well as a reduced deductible methods you pay much less out-of-pocket after a mishap. As a general rule, reduced costs are connected with greater deductibles and also higher costs are connected with reduced deductibles. auto.

liability insured car affordable car insurance affordable

liability insured car affordable car insurance affordable

If you have actually had a background of regular fender benders or accidents, after that maybe best for you to decide for the higher premium/lower insurance deductible option (vans). On the various other hand, the lower premium/higher insurance deductible might be a better choice if your driving record is excellent or has a couple of infrequent driving events.

Excitement About What Does Deductible Mean In Car Insurance?

Do not forget to evaluate your car insurance policy deductible a minimum of yearly as well as ask on your own if your monetary scenario (or other aspects believe adolescent driver for circumstances!) has actually transformed because the deductible was set as well as if the deductible quantity is still something you can comfortably pay if you had a car mishap today (car).

Learn what an automobile insurance policy deductible is and also just how it affects your cars and truck insurance policy protection. The key is understanding what deductibles as well as insurance coverages are and also exactly how they impact auto insurance.

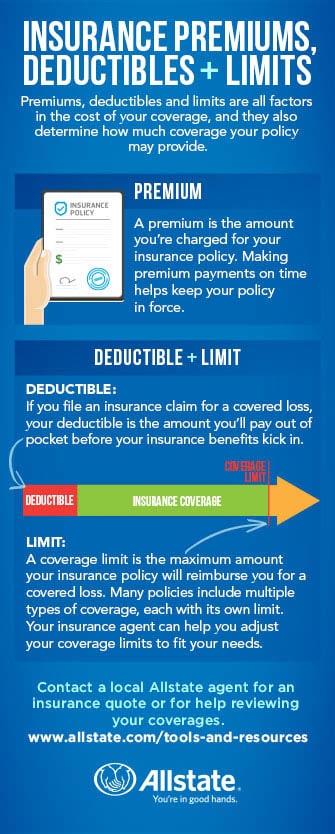

What is an insurance deductible? Put just, an insurance deductible is the amount that you consent to pay up front when you make an insurance case, while the insurer pays the remainder approximately your protection restriction. When selecting your automobile insurance policy deductible, think of just how much you agree to pay of pocket if you require to make an insurance claim (laws).

It actually boils down to what makes you the most comfortable. Vehicle insurance plan typically are composed of several type of coverages. Due to the fact that insurance coverage laws vary from one state to another, the complying with details is below to offer you a wide review of common protections, and also it isn't a declaration of agreement.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) car low cost auto cars cheap car

car low cost auto cars cheap car

Without insurance vehicle driver This insurance coverage pays for problems if you or another covered individual is harmed in a vehicle collision triggered by a vehicle driver who does not have liability insurance. In some states, it might also pay for home damage. The coverage differs by state and also relies on plan arrangements (risks). Without insurance driver insurance coverage undergoes a policy restriction picked by the insured.

See This Report about Car Insurance Deductibles & How They Work

low cost auto perks affordable auto insurance cheap car

low cost auto perks affordable auto insurance cheap car

Underinsured driver insurance coverage is subject to a policy limits picked by the guaranteed. Rental reimbursement This protection pays for rental expenses if your vehicle is disabled due to a covered loss.

Your cars and truck insurance deductible is the collection amount of cash you need to pay toward vehicle insurance policy repair work. The staying balance is paid by your insurance coverage business. You're in a crash that causes $6,000 worth of damages to your car and your deductible is $500. You pay $500 and also your insurance policy pays $5,500 toward the repair services.

Deductibles normally range anywhere from $200-$2000. The most typical deductible quantity is $500. Keep the below proportion in mind when picking your deductible amount: Lower deductible = Greater cars and truck insurance price as well as lower expense expenses, Higher deductible = Lower car insurance rate and also higher expense costs.

Your insurance provider then subtracts your deductible quantity from your claim's payout amount. As an instance, let's state your claim is authorized for $2,500 as well as your deductible is $500.

- In other words, there is no deductible in a liability case. As much as your policy's restriction, you pay absolutely nothing towards any type of problems or injuries you created another person. Your insurance coverage spends for the liability claim. - A few states use the alternative of selecting a $0 insurance deductible on detailed insurance coverage (dui).

What Does It Mean If I Have A $1,000 Deductible? - Budgeting ... Can Be Fun For Everyone

Some insurer (like Progressive), deal this in instances where glass repair work is possible. money. It is necessary to pick the appropriate vehicle insurance deductible Ensure you pick the most effective car insurance coverage deductible for your requirements. Do not fail to remember to consider your out-of-pocket abilities, your automobile's well worth, as well as the kind of insurance coverage.

When it concerns car insurance coverage, an insurance deductible is the quantity you would certainly have to pay of pocket after a covered loss prior to your insurance coverage begins. Automobile insurance deductibles function differently than clinical insurance policy deductibles with vehicle insurance coverage, not all kinds of insurance coverage need an insurance deductible. Liability insurance does not need an insurance deductible, however comprehensive and also crash protection generally do - insurance companies.

When you're adding that insurance coverage to your auto insurance coverage, you'll normally have the possibility to decide where you want to set the insurance deductible. Commonly, the greater you set your insurance deductible, the reduced your monthly insurance coverage premiums will be however you do not intend to set it so high that you would not be able to really pay that quantity if required.

What does a cars and truck insurance coverage deductible mean? A insurance deductible is the amount of money you have to pay of pocket prior to your automobile insurance will certainly cover the rest. As an example, if you backed your cars and truck right Find out more into an utility pole, your accident insurance policy would certainly pay for the expense of the damage.

If the overall cost of repair services comes to $1800, your insurance will only spend for $1300. You can find your deductible quantities is listed on your declarations web page (cheapest car). Needing to pay a deductible ways you can do a kind of cost-benefit analysis prior to you make a claim with your insurance company.

Car Insurance Deductibles & How They Work - The Facts

We don't offer your information to 3rd celebrations. What kind of protection requires a deductible? Not all sorts of car insurance policy coverage call for an insurance deductible. Responsibility insurance coverage, which covers the costs if you damage somebody's residential or commercial property or hurt a person with your automobile, never ever needs a deductible. Liability coverage is the backbone of a lot of car insurance plan, and also in most states in the united state, you're called for by legislation to have it.

Accident insurance covers damages to your automobile from a mishap, no issue that was at fault. Both accident and comp coverage generally require that you pay an out-of-pocket insurance deductible but you pick the amount, and also where you establish your insurance deductible will have an affect on your regular monthly insurance costs. Just how do I determine what my insurance deductible should be? Generally, the greater you set your deductible, the reduced your month-to-month costs.

The opposite is also real, picking a low insurance deductible means you'll have to pay a greater premium (insurance). You may be tempted to select a high insurance deductible in order to get a reduced insurance premium, however keep in mind, there's a really real possibility you'll have to pay that deductible one day. When choosing an insurance deductible, ensure it's an amount you 'd in fact carry hand if you required to pay it.

You are accountable for the first $1,000 of damages as well as your insurer is in charge of the various other $1,000 of protected damages. Crash as well as detailed are both most typical insurance coverages with a deductible. Accident-- this coverage aids spend for damages to your car if it hits an additional cars and truck or things or is struck by an additional car - cars.

There are also a few other things to recognize concerning deductibles. There are no deductibles for obligation insurance coverage, the insurance coverage that pays the other person when you cause a mishap. Cars and truck insurance policy deductibles relate to each mishap you remain in. If you get right into 3 accidents in a policy duration as well as have a $500 deductible, you'll generally be accountable for $500 for each claim.

Understanding Your Insurance Deductibles - Iii Can Be Fun For Anyone

What is a Vehicle Insurance Coverage Deductible? Your car insurance deductible is the amount you'll be liable for paying towards the costs due to a loss prior to your insurance protection pays.

Picking a higher deductible might decrease your automobile insurance policy premium. When Do You Pay a Vehicle Insurance Deductible?

cars insured car cheaper cheapest auto insurance

cars insured car cheaper cheapest auto insurance

What Are Responsibility Limitations and also How Do They Function? Your automobile insurance liability coverage limitations, likewise referred to as limitation of responsibility, are the most your insurance coverage will certainly pay to another event if you are lawfully accountable for a mishap. Umbrella policies are not required and also offered coverage limits and qualification demands might vary by state.

What is a deductible? A deductible is what you pay out of pocket to fix your automobile before your car insurance coverage pays for the rest. How does an insurance deductible work? If you bring detailed and also crash insurance coverage on your automobile insurance coverage, you will certainly see a deductible provided on your plan as a buck quantity.

Top Guidelines Of What Is A Deductible In Business Insurance? - Insureon

When do you pay your insurance deductible? You just pay the deductible for repair work made to your very own lorry.

Just how a lot will you conserve each year on costs? Would these financial savings make a meaningful influence on your budget plan? This is where the worth of your vehicle can be a big element. More recent automobiles are more pricey to change than older lorries. Therefore alone, you may see a large rate jump in your costs if you select the lower insurance deductible.

https://www.youtube.com/embed/n6Gwg-vvPYM

If you're still leaning towards a higher insurance deductible, assume regarding this: How long would it take to redeem what you'll spend on premium prices? If it's just going to take you a year or 2, the greater deductible may still be looking excellent - affordable car insurance. Or else, the reduced deductible may make even more feeling.